Seagate (STX): A Kiwi Investor's Dream - Is This Data Storage Gem Too Good to Pass Up?

In the ever-expanding world of data, finding solid investment opportunities can feel like searching for a needle in a haystack. But what if there's a gem hiding in plain sight? Today, we’re taking a close look at Seagate Technology Holdings (STX), a company that’s been quietly building a compelling case for investors, particularly those of us down here in Aotearoa.

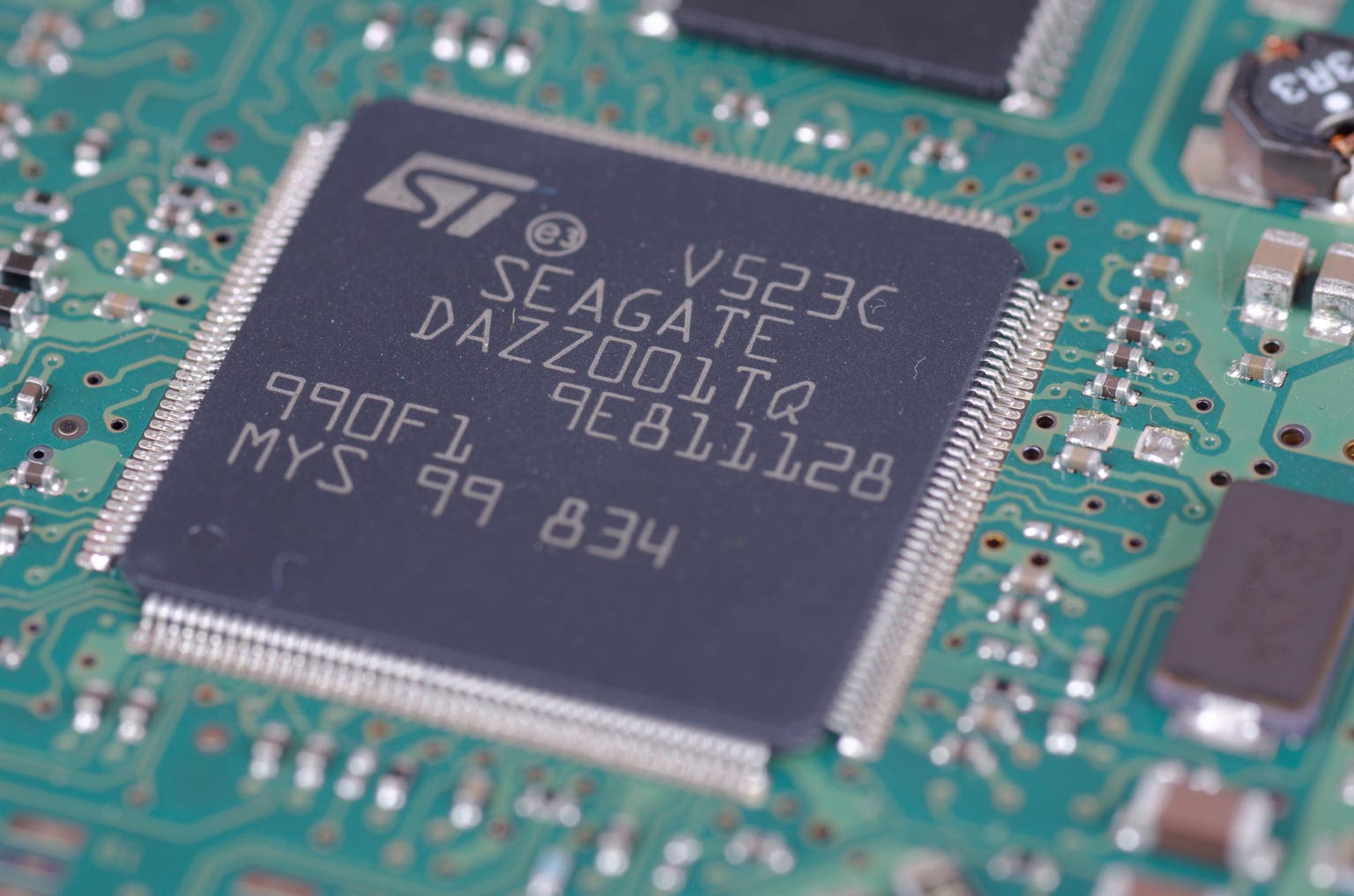

Seagate isn't exactly a household name, but it's a vital player in the global data storage landscape. They're the folks behind those hard drives and solid-state drives that power everything from your laptop to massive data centres. And right now, they’re sitting in a sweet spot – a confluence of factors that suggest this could be a seriously undervalued opportunity.

Why the Buzz Around Seagate?

Let's break down why Seagate is generating so much interest. Here are a few key reasons:

- Low PEG Ratio: The Price/Earnings to Growth (PEG) ratio is a fantastic tool for identifying potentially undervalued companies. Seagate’s low PEG suggests the market isn’t fully appreciating its growth potential. It's a red flag that it *might* be a bargain.

- Strong Growth: The data deluge isn’t slowing down. Cloud computing, AI, 5G – they all require massive amounts of storage. And Seagate is well-positioned to capitalise on this trend. The demand for data storage is only going to increase, and Seagate’s growth trajectory reflects that.

- HAMR Innovation: Seagate's Heat-Assisted Magnetic Recording (HAMR) technology is a game-changer. It allows for significantly higher storage densities, meaning more data can be packed into the same physical space. This is crucial for meeting the ever-increasing demands of the data market. It’s a competitive advantage that sets them apart.

- Surging Data Market: We've already touched on it, but it's worth reiterating: the data storage market is booming. This provides a powerful tailwind for Seagate's business.

The Kiwi Perspective - Why STX Matters to NZ Investors

For Kiwi investors, STX offers a compelling proposition. Diversifying your portfolio with companies operating in essential sectors like data storage is a smart move. The global nature of Seagate's business also means it's less susceptible to the vagaries of the New Zealand economy. Plus, the potential for significant capital gains as the market recognises Seagate’s true value is appealing.

A Word of Caution

Of course, no investment is without risk. The data storage market is competitive, and Seagate faces challenges from solid-state drive manufacturers and other storage technologies. Economic downturns could also impact demand. It’s always wise to do your own research and consider your own risk tolerance before investing.

The Verdict: A Strong Buy?

Based on the combination of a low PEG ratio, strong growth prospects, innovative technology, and a surging data market, Seagate (STX) presents a compelling investment opportunity. While there are risks to consider, the potential rewards seem to outweigh them. For Kiwi investors looking for a solid, globally-exposed stock, Seagate deserves a serious look. Could this be the 'too good to be true' opportunity we've been waiting for? Time will tell, but the signs are certainly encouraging.