SanDisk: Why This Storage Tech Giant Still Has Plenty of Upside - A Kiwi Investor's Take

SanDisk (SNDK) has been facing headwinds, with recent revenue declines causing some concern. But don't write off this storage technology leader just yet! As a Kiwi investor, I've been digging into the numbers and the long-term trends, and I believe SanDisk has significant potential for a rebound. This article dives into the current challenges, management's optimistic outlook, and why I'm still bullish on SNDK – particularly considering the evolving landscape of data storage and the increasing demand for reliable, high-capacity solutions.

The Current Landscape: A Bit of a Dip

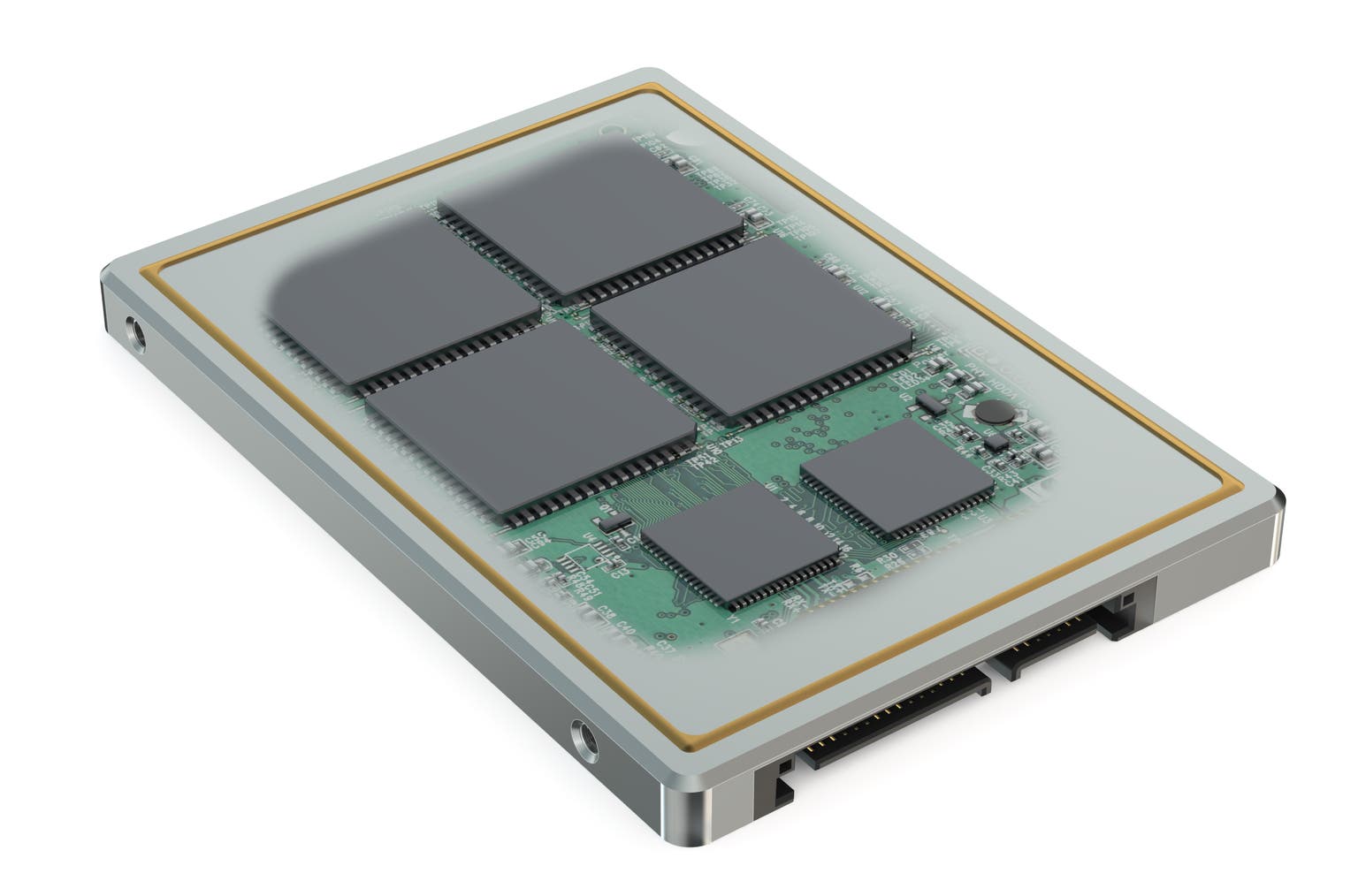

Let's be honest, the numbers haven't been stellar recently. SanDisk, a key player in flash memory cards, USB drives, and solid-state drives (SSDs), has seen its revenue impacted by a few factors. Global economic uncertainty, fluctuating semiconductor prices, and shifts in consumer demand have all played a role. We’ve also seen increased competition in the market, putting pressure on margins. It’s a tough environment for any tech company, and SanDisk is no exception.

Management's Perspective: Seeing the Light at the End of the Tunnel

Despite the current challenges, SanDisk's management team remains confident. They're pointing to several key factors that suggest a recovery is on the horizon. Firstly, the long-term demand for data storage continues to grow exponentially. Think about it – everything from smartphones and laptops to data centres and autonomous vehicles requires massive amounts of storage. Secondly, SanDisk is investing heavily in next-generation technologies, including advanced NAND flash memory and innovative storage solutions for emerging markets like automotive and industrial applications.

Why I'm Still Bullish: The Fundamentals are Strong

Here's why I, as a Kiwi investor, am keeping a close eye on SanDisk:

- Dominant Market Position: SanDisk remains a leading player in the flash memory market, with a strong brand reputation and a loyal customer base.

- Technological Innovation: Their commitment to R&D and their focus on next-generation storage technologies positions them well for future growth. They are constantly pushing the boundaries of what's possible in terms of storage density and performance.

- Diversified Applications: SanDisk’s products are used in a wide range of applications, reducing their reliance on any single market segment. From consumer electronics to enterprise solutions, they’ve got their fingers in a lot of pies.

- Strategic Partnerships: SanDisk has established strong partnerships with key players in the technology industry, which provides them with access to new markets and opportunities.

- Long-Term Growth Trends: The overall trend of increasing data storage needs is undeniable. As more and more devices become connected and data-driven, the demand for reliable and high-capacity storage will only continue to grow.

A Kiwi Investor's Perspective: Patience is Key

Investing in the tech sector can be volatile, and SanDisk is no different. There will likely be ups and downs along the way. However, I believe that SanDisk's strong fundamentals, management's optimistic outlook, and the long-term growth trends make it a worthwhile investment for Kiwi investors with a long-term perspective. It's important to remember that patience is key, and to stay informed about the latest developments in the industry.

Disclaimer: *This is not financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.*