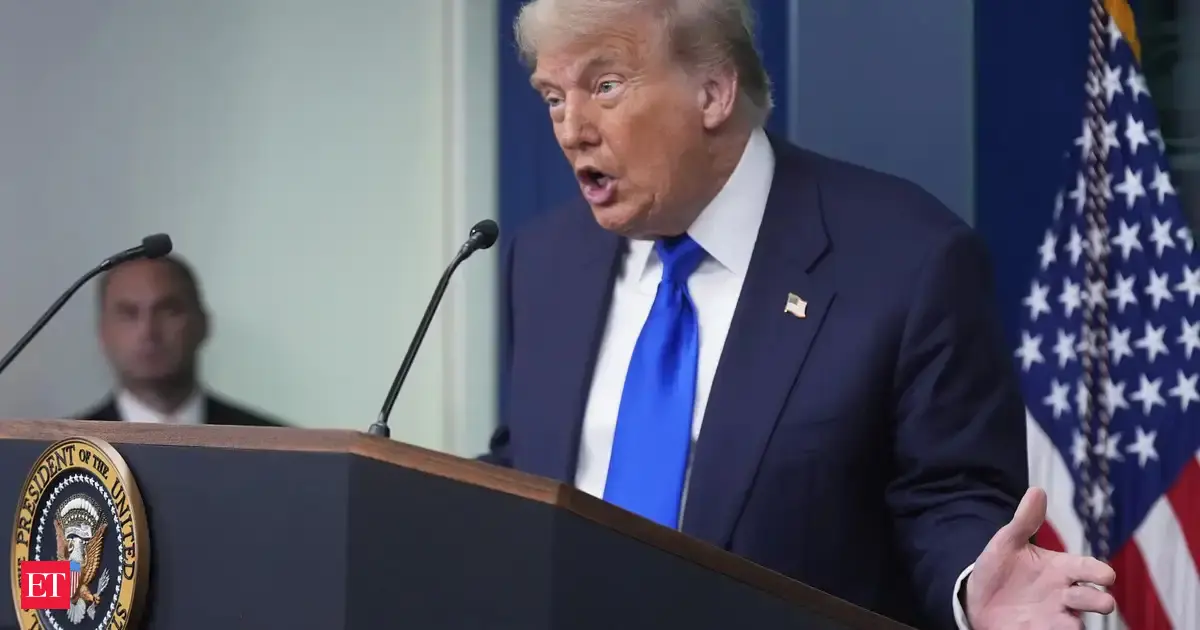

Trump Halts US-Canada Trade Talks, Citing Tech Tax as 'Attack'

In a surprising move that threatens ongoing trade negotiations, US President Donald Trump announced Friday he is suspending trade talks with Canada. The core issue? Canada's planned digital services tax targeting major technology firms. Trump labelled the tax a “direct and blatant attack” on the United States, escalating tensions between the two nations.

The digital services tax, a policy increasingly adopted by various countries worldwide, aims to tax revenue generated by large tech companies like Google, Facebook, and Amazon within their borders. Canada’s proposed tax is similar to those already in place in France and other European nations, and is intended to ensure these companies pay a fairer share of taxes for their operations.

However, the US government views these taxes as discriminatory, arguing they unfairly target American companies and violate international trade rules. Trump's administration has been actively pushing for a global agreement on how to tax digital services, and has expressed frustration with Canada's unilateral approach.

“We’ve been talking about this for a long time. Canada is going to impose a tax on our technology companies… a very unfair tax,” Trump stated. “Therefore, we’re withdrawing from the trade talks. We’re not going to negotiate with a country that’s acting so unfairly.”

Impact on US-Canada Relations & Trade Deal

The suspension of trade talks represents a significant setback for the US-Canada relationship and the ongoing renegotiation of the USMCA (United States-Mexico-Canada Agreement), the successor to NAFTA. While the USMCA itself remains in place, the breakdown in negotiations raises concerns about future trade cooperation and potential retaliatory measures.

Experts suggest that the US could impose tariffs on Canadian goods in response to the digital services tax, mirroring actions already taken against the European Union. This could further escalate the trade dispute and negatively impact businesses and consumers in both countries.

Global Context & Digital Tax Debate

Trump’s actions highlight the growing global debate surrounding the taxation of digital services. Many countries are seeking ways to ensure that multinational tech companies pay their fair share of taxes, particularly as traditional corporate tax structures struggle to keep pace with the digital economy. However, the US and other nations are wary of unilateral measures that could lead to trade wars and disrupt the global economy. The OECD (Organisation for Economic Co-operation and Development) has been working on a global framework for digital taxation, but progress has been slow.

The situation with Canada is likely to put further pressure on the OECD to reach a consensus soon. Without a global agreement, more countries could implement their own digital services taxes, leading to a fragmented and unpredictable tax landscape for multinational corporations.

Looking Ahead

The future of US-Canada trade talks remains uncertain. While Trump has indicated a willingness to resume negotiations if Canada withdraws its digital services tax, the Canadian government has so far stood firm on its policy. The dispute underscores the complexities of international trade and the challenges of navigating the evolving digital economy. Observers will be closely watching how the situation unfolds and whether a resolution can be reached before it further damages US-Canada relations.