Trump Halts Trade Talks with Canada over Tech Tax – Tariffs Loom?

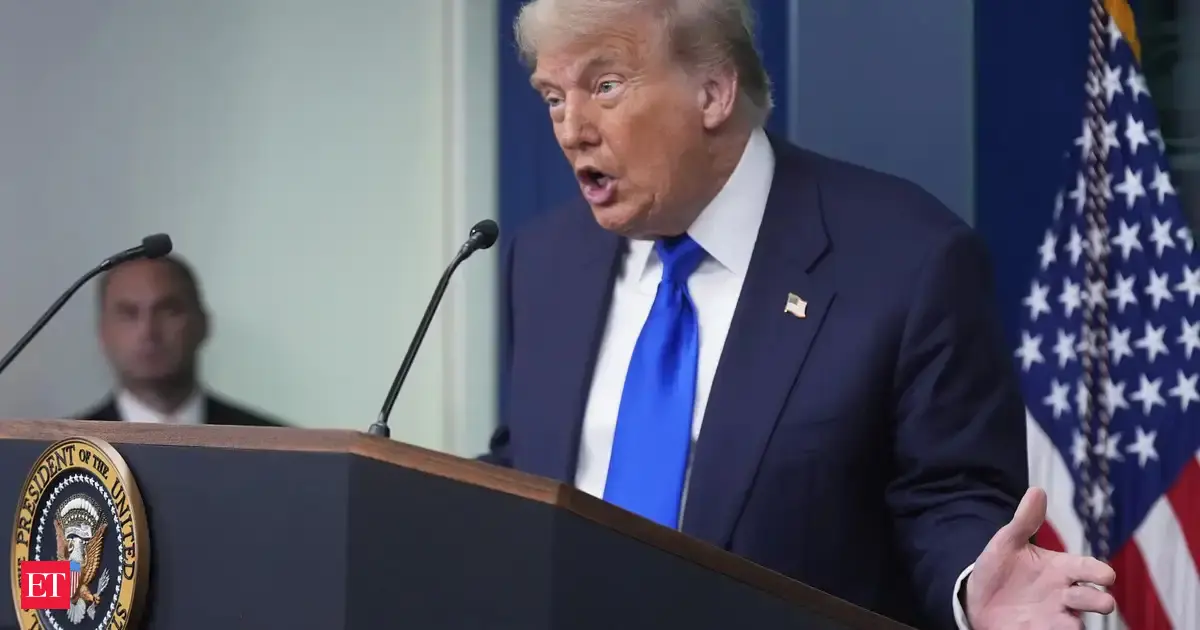

Washington D.C. - In a move that could escalate tensions between the United States and Canada, President Donald Trump has announced the suspension of trade negotiations, citing Canada's proposed digital services tax targeting technology companies. Trump labelled the tax as “egregious” and a direct attack on American businesses, setting the stage for potential retaliatory tariffs.

The digital services tax, implemented by Canada, aims to tax revenue generated by large tech firms like Google, Facebook, and Amazon from Canadian users. This follows a global trend of countries seeking to tax the profits of multinational tech companies, which often operate with relatively low tax rates in their home countries.

“We are ending the trade talks with Canada,” Trump stated, adding he would impose tariffs within seven days if Canada doesn’t back down. The specific products targeted by these tariffs remain unclear, but the threat is significant and could impact a wide range of goods traded between the two nations.

Why is this happening? The U.S. argues that Canada's tax unfairly targets American companies and is a discriminatory measure. They believe it’s a prelude to similar taxes being implemented by other countries, potentially harming U.S. businesses across the board. The U.S. is pushing for a global agreement on how to tax digital services, preferably through the Organisation for Economic Co-operation and Development (OECD).

Canada, on the other hand, defends its tax as a necessary measure to ensure that large tech companies pay their fair share of taxes within its borders. They argue that these companies derive significant revenue from Canadian users and should contribute to the Canadian economy.

Impact on Trade and the Economy The suspension of trade talks and the threat of tariffs have sent ripples through the business community. A trade war between the U.S. and Canada, two of the largest trading partners, would have significant economic consequences for both countries. It could disrupt supply chains, increase prices for consumers, and hurt businesses reliant on cross-border trade.

Global Context: A Growing Trend Canada is not alone in implementing a digital services tax. Several European countries, including France and the UK, have already introduced similar taxes, and others are considering doing so. This reflects a growing international concern about the taxation of digital giants and the need to update tax laws to reflect the realities of the digital economy.

What’s Next? The situation remains fluid. The next few days will be crucial in determining whether the U.S. and Canada can resolve their differences. Negotiations could resume, or tariffs could be imposed, potentially leading to a prolonged trade dispute. The outcome will have significant implications for the future of trade relations between the two countries and the global landscape of digital taxation. The OECD is still working towards a global solution, but progress has been slow, and the pressure is mounting for countries to take unilateral action.