Micron (MU) Stock Buzz: What New Zealand Investors Need to Know

Micron Technology (MU) has been generating a lot of investor interest lately, especially here in New Zealand. It's been one of the most searched-for stocks on investment platforms, and for good reason. Let's dive into the key factors that could influence Micron's performance in the coming months, so you can make informed decisions about your portfolio.

The Recent Surge in Interest

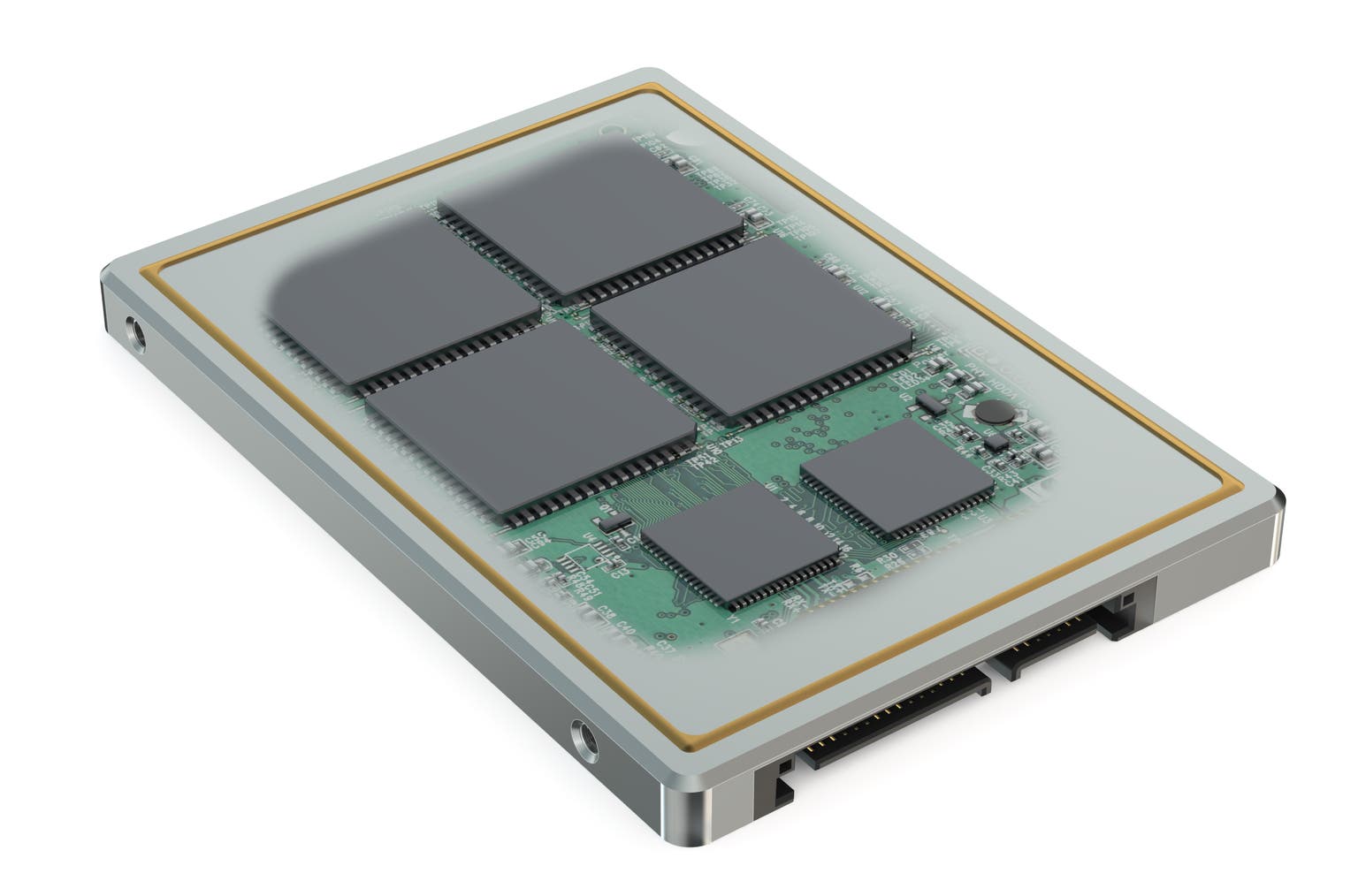

The recent uptick in searches for Micron (MU) suggests a growing appetite among investors to understand this tech giant. This interest isn’t unfounded, as Micron plays a critical role in the global semiconductor market, producing memory and storage solutions vital for everything from smartphones to data centres. Understanding the drivers behind this increased attention is the first step in evaluating its potential.

Understanding Micron's Business

Micron isn’t just about chips; it's about enabling technological advancements. They're a leading manufacturer of DRAM (Dynamic Random-Access Memory) and NAND flash memory – the building blocks of modern computing and data storage. The demand for these components is directly linked to trends like cloud computing, artificial intelligence, and the proliferation of connected devices. This places Micron in a strategically important position within the tech ecosystem.

Factors to Consider: Recent Performance & Market Trends

Over the past month, Micron's stock has shown volatility, reflecting broader economic uncertainties and shifts in the semiconductor landscape. Several factors are at play:

- Global Economic Outlook: Concerns about a potential economic slowdown have impacted investor sentiment across various sectors, including technology.

- Memory Chip Pricing: The memory chip market is cyclical, with periods of high demand and pricing followed by corrections. Current market conditions suggest a softening in pricing, which can impact Micron's revenue.

- AI Boom & Demand for High-Bandwidth Memory (HBM): The rapid growth of AI is creating significant demand for advanced memory solutions, particularly HBM. Micron is investing heavily in HBM technology, and its success in this area could be a major catalyst for future growth.

- Geopolitical Risks: The semiconductor industry is heavily influenced by geopolitical factors, including trade tensions and supply chain disruptions. These risks can create uncertainty for Micron and its investors.

What Does This Mean for New Zealand Investors?

For Kiwi investors considering Micron, a cautious but optimistic approach is warranted. While short-term volatility is likely, the long-term outlook for the memory chip market remains positive, driven by the continued growth of data-intensive applications. It's crucial to do your own research, consider your risk tolerance, and potentially consult with a financial advisor before making any investment decisions.

Key Takeaways

- Micron is a key player in the semiconductor industry, essential for many modern technologies.

- The stock's recent performance reflects broader economic uncertainties and market trends.

- The AI boom and Micron’s HBM investments offer potential growth opportunities.

- Careful consideration of risks and a long-term perspective are important for New Zealand investors.