SanDisk: Why This Storage Giant Could Still Be a Smart Investment Despite Current Headwinds

SanDisk Corporation (SNDK) has recently faced headwinds, with revenue declines impacting the company's performance. However, beneath the surface, a compelling story of innovation and long-term potential remains. While current market conditions present challenges, management's optimistic outlook and SanDisk’s core strengths suggest a bright future for the company.

Understanding the Current Challenges

The recent slowdown in the memory storage market, particularly in the consumer electronics sector, has undoubtedly impacted SanDisk. Factors like softening smartphone demand and a cautious approach to inventory management by key customers have contributed to the revenue decline. Furthermore, the rise of alternative storage solutions and increased competition are putting pressure on pricing and margins. Investors are understandably concerned about these short-term pressures.

Why SanDisk Remains a Strong Player

Despite these challenges, it’s crucial to look beyond the immediate numbers and consider SanDisk's inherent strengths. Here’s why I believe SNDK has a bright future:

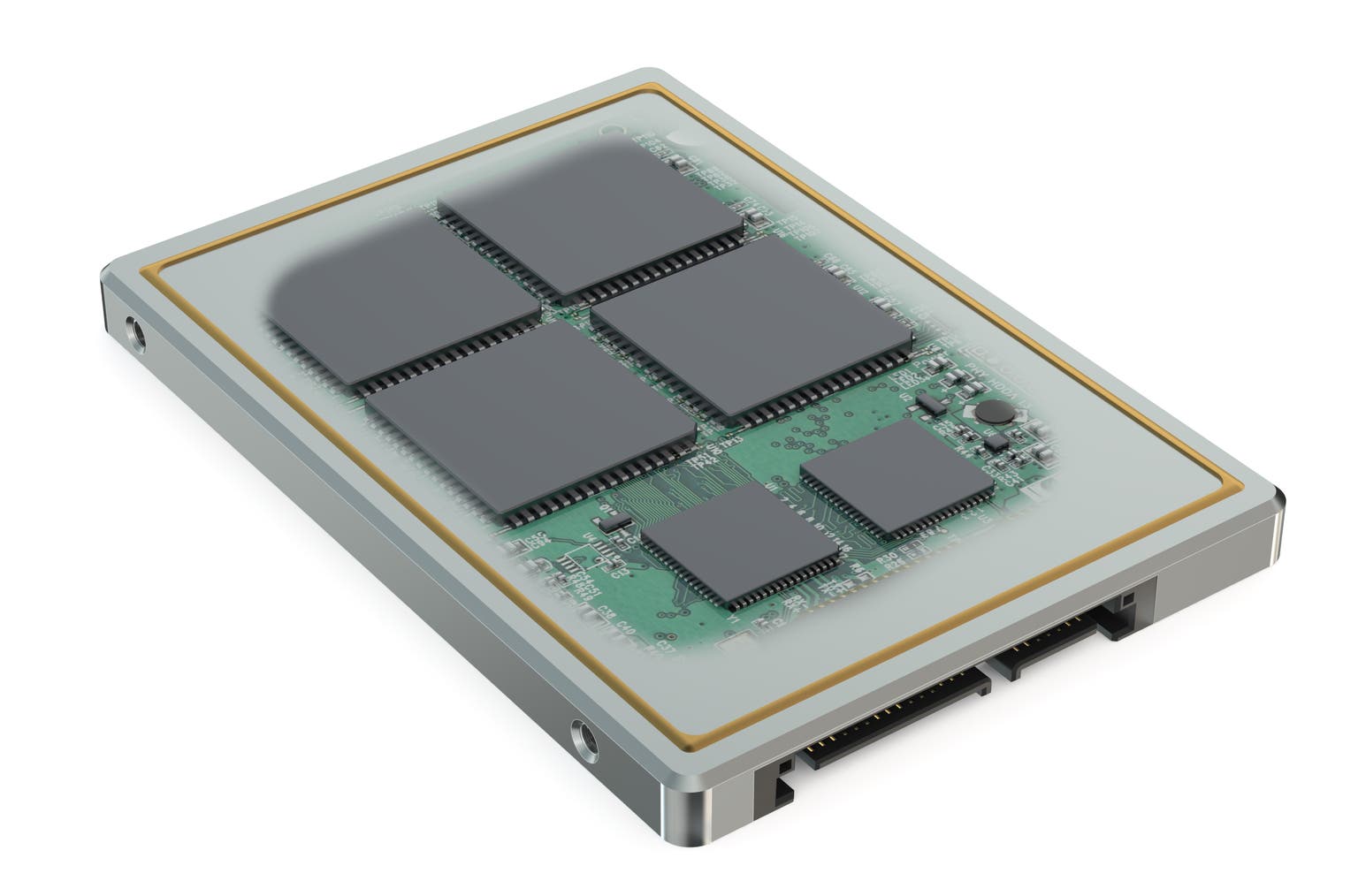

- Technological Leadership: SanDisk has consistently been a leader in NAND flash memory technology. Their ongoing investments in research and development ensure they remain at the forefront of innovation, developing higher-density, faster, and more reliable storage solutions. This technological edge is difficult to replicate.

- Diverse Product Portfolio: SanDisk isn’t solely reliant on consumer memory cards. They serve a wide range of markets, including industrial, automotive, and enterprise applications. This diversification reduces their vulnerability to downturns in any single sector. The automotive segment, in particular, presents a significant growth opportunity as vehicles increasingly rely on data storage for infotainment, autonomous driving features, and advanced driver-assistance systems (ADAS).

- Strong Brand Recognition: The SanDisk brand is synonymous with quality and reliability in the storage market. This strong brand equity provides a competitive advantage and allows them to command premium pricing.

- Western Digital Synergy: SanDisk's integration with Western Digital provides significant synergies in terms of manufacturing, supply chain management, and research and development. This partnership strengthens their position in the overall storage market.

- Management's Optimistic Outlook: Western Digital's management team expresses confidence in SanDisk’s long-term prospects, citing the cyclical nature of the memory market and the company’s ability to navigate challenging periods. They are actively managing costs and focusing on high-growth areas.

Looking Ahead

The memory storage market is inherently cyclical. While the current downturn is undeniable, historical data suggests that demand will eventually rebound. SanDisk’s strong technology, diverse portfolio, and strategic partnership with Western Digital position them well to capitalize on this recovery. Investors should focus on the long-term potential and consider the current challenges as a potential buying opportunity.

Investment Considerations

Before investing, it’s important to acknowledge the risks. Continued macroeconomic uncertainty, increased competition, and potential supply chain disruptions could impact SanDisk’s performance. However, for investors with a long-term perspective, SanDisk's fundamentals remain compelling. Monitoring key metrics like NAND pricing, automotive storage demand, and Western Digital’s overall financial performance will be crucial.

Disclaimer: I am not a financial advisor. This is not financial advice. Please conduct your own research before making any investment decisions.