Maine Residents Brace for Sticker Shock: Health Insurance Rates Poised for Dramatic Increase

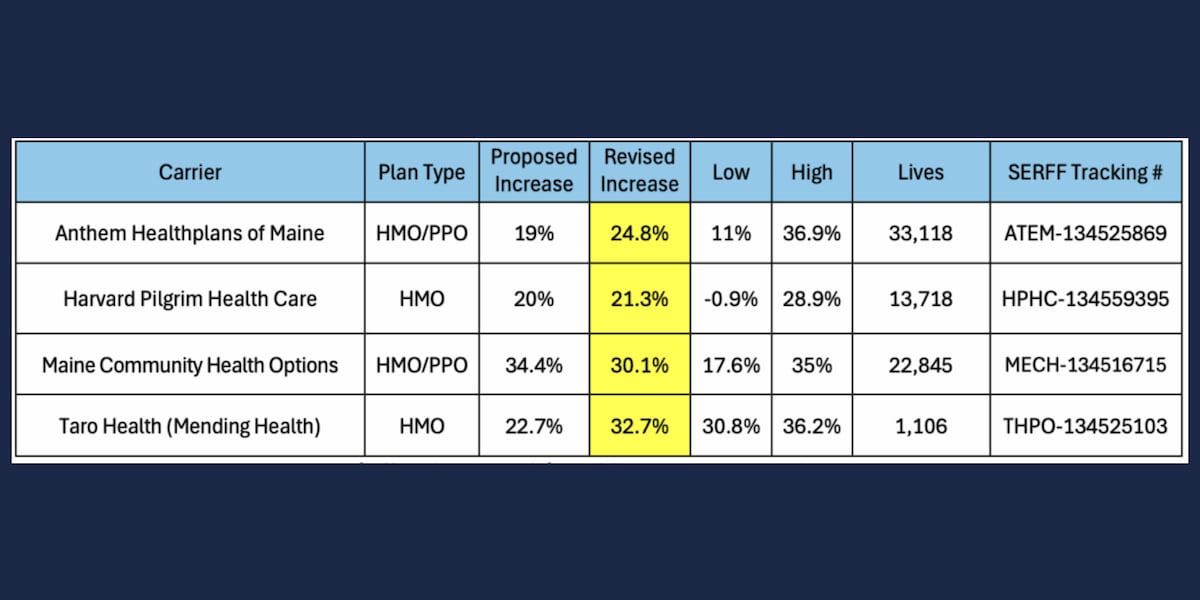

Maine residents are facing a tough reality as health insurance rates are expected to surge significantly in the coming year. This isn't just a slight adjustment – experts are predicting a substantial increase, leaving many families struggling to afford essential healthcare coverage. But what's driving this dramatic rise?

The primary culprits, according to industry analysts, are twofold: the escalating costs of prescription drugs and a concerning lack of competition within Maine's health insurance market. Let's break down each factor and explore the potential impact on Mainers.

The Prescription Drug Price Problem

Nationally, the cost of prescription drugs has been a major point of contention for years. Maine is not immune to this trend. Pharmaceutical companies continue to raise prices on essential medications, impacting both individuals and insurance providers. Insurance companies ultimately absorb a portion of these costs, which they then pass on to consumers in the form of higher premiums. The complexity of drug pricing, including rebates and discounts negotiated between insurers and manufacturers, adds to the opacity and difficulty in controlling costs.

Limited Competition Fuels the Fire

Maine's health insurance market isn't as competitive as it should be. With fewer insurers vying for customers, there's less pressure to keep premiums low. This lack of competition allows existing insurers to raise rates without fear of losing significant market share. The reasons for this limited competition are varied, including regulatory hurdles, the cost of doing business in Maine, and the relatively small population size, making it less attractive to national insurers.

What Does This Mean for Maine Families?

The projected rate increases will have a ripple effect across the state. Families already struggling to make ends meet will face even tougher choices, potentially delaying or forgoing necessary medical care. Small business owners, who often provide health insurance for their employees, may be forced to reduce benefits or shift costs onto their workforce. Even those with employer-sponsored insurance could see their premiums and out-of-pocket expenses rise.

Looking Ahead: Potential Solutions

Addressing this crisis requires a multi-pronged approach. Possible solutions include:

- Increased Competition: Efforts to attract new insurers to Maine, perhaps through incentives or regulatory reforms, could help drive down prices.

- Prescription Drug Cost Controls: Maine could explore strategies to negotiate lower drug prices, similar to what some other states have done. Legislative action could also focus on increasing transparency in drug pricing.

- Subsidies and Assistance Programs: Expanding access to subsidies and financial assistance programs can help low-income individuals and families afford coverage.

- Promoting Value-Based Care: Shifting away from fee-for-service models towards value-based care, which rewards quality and outcomes rather than quantity, could help control costs in the long run.

The situation in Maine highlights a broader national challenge: ensuring affordable access to healthcare. While the path forward is complex, decisive action is needed to protect the health and financial well-being of Maine residents.