ASE Technology Holding (ASX) Q2 2025 Earnings Miss: Key Takeaways and Future Outlook

ASE Technology Holding (ASX) Disappoints in Q2 2025, But What's Next?

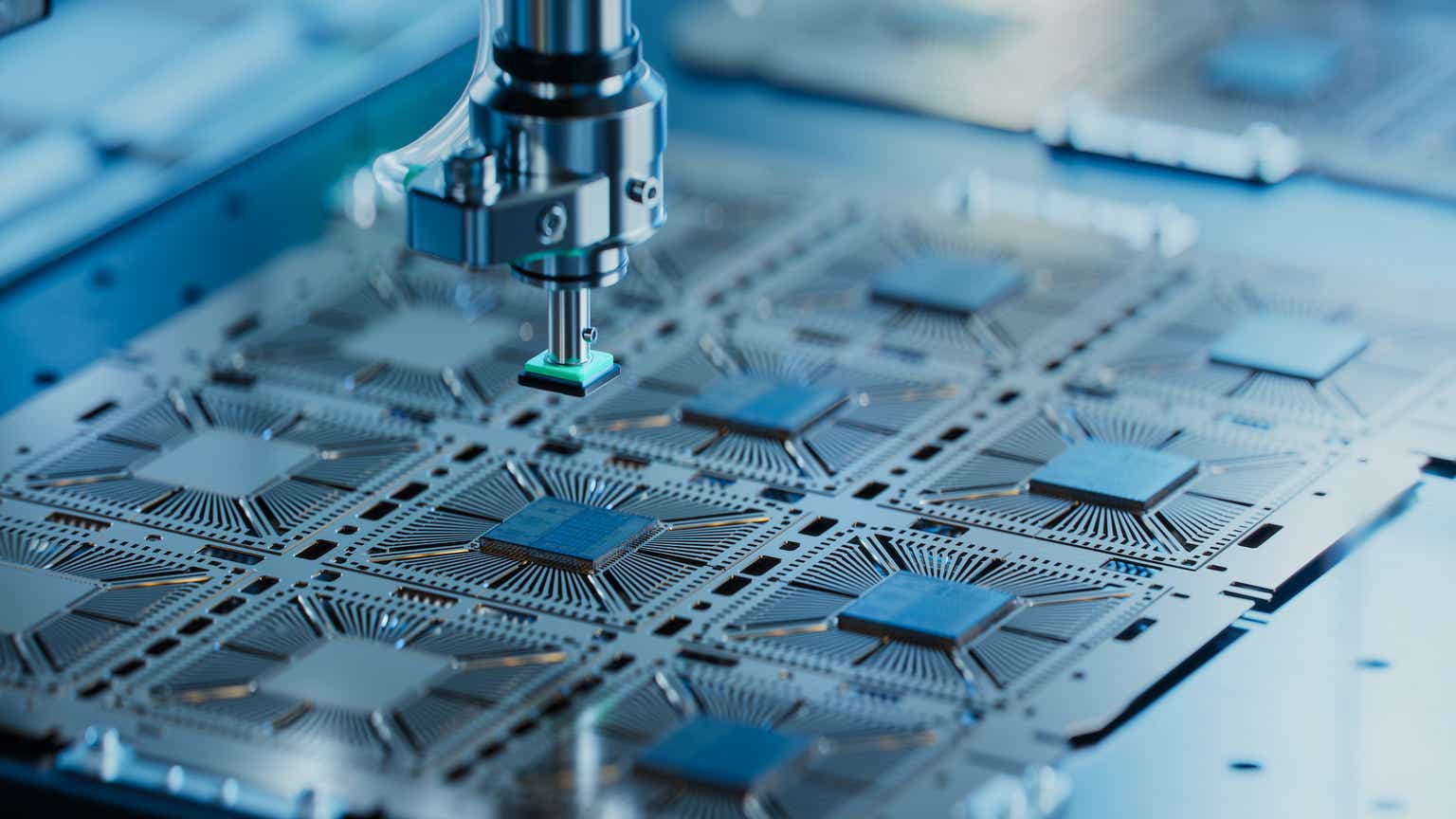

ASE Technology Holding Co., Ltd. (NYSE:ASX), a leading global provider of semiconductor packaging and testing services, recently released its Q2 2025 earnings report. While the company remains a significant player in the industry, the results fell short of analyst expectations, sparking investor interest and prompting a closer look at the underlying factors. This transcript details the key points from the July 31, 2025, earnings call, featuring remarks from Kenneth Hsiang and other key executives.

Key Financial Highlights: A Miss on Earnings

The headline figure for Q2 2025 was an earnings per share (EPS) of $0.11, compared to the anticipated $0.1346. This miss, while not drastic, signals potential headwinds and warrants examination. Revenue figures and other financial details will be discussed further in the analysis below, but the EPS shortfall immediately caught the attention of market observers.

Kenneth Hsiang's Opening Remarks and Context

The earnings call began with opening remarks from Kenneth Hsiang, who set the stage for the discussion. He acknowledged the challenging macroeconomic environment and its impact on the semiconductor industry as a whole. Hsiang emphasized ASE's commitment to navigating these challenges and maintaining its position as a leader through strategic investments and operational efficiencies. The initial overview painted a picture of a company facing external pressures but actively working to mitigate their effects.

Diving Deeper: Factors Contributing to the Earnings Miss

Several factors likely contributed to the EPS miss. These may include:

- Weakening Demand: The semiconductor cycle is inherently cyclical, and a potential slowdown in demand for certain types of chips could have impacted ASE's order book.

- Increased Competition: The packaging and testing market is becoming increasingly competitive, potentially putting pressure on pricing and margins.

- Supply Chain Disruptions: While supply chain issues have eased compared to previous years, lingering challenges could still be impacting production and delivery schedules.

- Macroeconomic Uncertainty: Global economic uncertainty, including inflation and interest rate hikes, can dampen investment in the semiconductor sector.

Looking Ahead: ASE's Strategy and Future Outlook

Despite the Q2 disappointment, ASE's management expressed optimism about the long-term prospects of the company. Key strategic initiatives being pursued include:

- Advanced Packaging: ASE is heavily investing in advanced packaging technologies, such as fan-out wafer-level packaging (FOWLP) and 2.5D/3D integration, which are crucial for next-generation chips.

- Diversification: Expanding into new markets and applications, such as automotive and artificial intelligence, to reduce reliance on any single sector.

- Operational Excellence: Continuously improving operational efficiency and reducing costs to maintain competitiveness.

The call highlighted the company's belief that these investments will position ASE for sustainable growth in the years to come. Management also addressed questions from analysts regarding the impact of geopolitical tensions and potential trade restrictions.

Key Takeaways and Investor Considerations

The Q2 2025 earnings report from ASE Technology Holding presented a mixed picture. While the EPS miss is a cause for concern, the company's strategic initiatives and long-term outlook remain positive. Investors should closely monitor the following factors:

- Semiconductor Demand: The overall health of the semiconductor industry will be a key driver of ASE's performance.

- Advanced Packaging Adoption: The rate at which advanced packaging technologies are adopted by chipmakers.

- Competitive Landscape: ASE's ability to maintain its competitive edge in a rapidly evolving market.