Portman Ridge & Logan Ridge Merger: Proceed with Caution – Is PTMN Stock a Risky Bet?

The recent announcement of a merger between Portman Ridge Finance (PTMN) and Logan Ridge Finance (LRFC) has sent ripples through the financial community. While the promise of synergies and a potentially stronger combined entity is appealing, a closer look reveals reasons for caution. This article dives deep into the details of the merger, examining the potential benefits alongside the inherent risks. We'll explore why, despite the initial excitement, investors should approach PTMN stock with a degree of skepticism.

Understanding the Merger: A Marriage of Two Firms

Portman Ridge Finance and Logan Ridge Finance are both specialized finance companies focusing on niche lending strategies. The merger aims to create a larger, more diversified platform capable of accessing a wider range of investment opportunities and benefiting from economies of scale. Proponents argue that combining the expertise and resources of both firms will lead to improved operational efficiency and enhanced returns for shareholders. Specifically, the combined entity hopes to streamline management, reduce overhead, and create better access to capital markets.

The Allure of Synergies: What's the Upside?

The core argument for the merger rests on the idea of 'synergies.' These are the benefits that arise from combining two businesses that are greater than the sum of their individual parts. In this case, potential synergies include:

- Expanded Investment Mandate: A larger firm can pursue a broader range of investment strategies, reducing reliance on any single sector or asset class.

- Improved Pricing Power: Increased scale can lead to better pricing on debt and other funding sources.

- Operational Efficiencies: Combining back-office functions and reducing duplication can lower operating costs.

- Enhanced Access to Capital: A larger, more stable entity is likely to attract a wider range of investors and potentially lower borrowing costs.

Reasons for Caution: The Potential Pitfalls

However, mergers are complex undertakings, and the road to success is rarely smooth. Several factors warrant a cautious approach to PTMN stock:

- Integration Challenges: Combining two distinct corporate cultures and operational systems can be a significant hurdle. Failed integrations can lead to inefficiencies and lost productivity.

- Dilution: The merger structure often involves issuing new shares, which can dilute existing shareholders' ownership stake.

- Management Overlap: Consolidating management teams can lead to redundancies and potential disruptions.

- Regulatory Scrutiny: Mergers of this size often attract scrutiny from regulatory bodies, which can delay the process or impose conditions that negatively impact the combined entity.

- Market Volatility: The current economic climate is characterized by uncertainty and volatility. This can make it more difficult to realize the anticipated benefits of the merger.

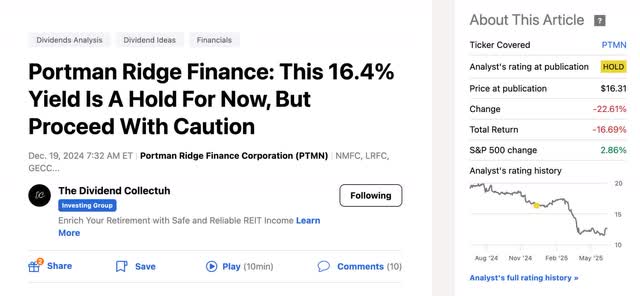

The Verdict: A Measured Approach to PTMN Stock

While the Portman Ridge and Logan Ridge merger holds potential, the risks are undeniable. Investors should carefully weigh the potential benefits against the significant challenges that lie ahead. A 'proceed with caution' approach is warranted, particularly given the current market conditions. Thorough due diligence and a clear understanding of the integration plan are essential before investing in PTMN stock. Consider consulting with a financial advisor to assess your individual risk tolerance and investment goals. The merger's success hinges on effective integration and a favorable economic environment – factors that remain uncertain at this time.