Navigating the Risks & Rewards of CQQQ: A Deep Dive into Invesco's China Tech ETF

The allure of China's booming technology sector is undeniable, attracting investors worldwide. However, tapping into this potential isn't without its complexities. The Invesco China Technology ETF (CQQQ) offers a readily accessible route, but understanding the inherent risks is paramount. This article breaks down the key considerations for investors contemplating CQQQ, exploring the regulatory landscape, government influence, and index limitations that can significantly impact performance.

Understanding the Landscape: Regulatory Headwinds & Government Intervention

China's regulatory environment for the tech sector has undergone significant shifts in recent years. From data privacy concerns to antitrust scrutiny and restrictions on overseas listings, government intervention has become a frequent occurrence. These actions can directly impact the profitability and growth prospects of companies within the CQQQ portfolio. Investors need to be acutely aware of these ongoing developments and their potential ripple effects.

Specifically, areas like fintech, online gaming, and data security are under intense scrutiny. New regulations can emerge quickly, creating uncertainty and potentially leading to significant market volatility. While some argue these regulations are intended to foster a healthier and more sustainable tech ecosystem, they undoubtedly present challenges for short-term investors.

The Index Limitation Factor: Missing Major Players

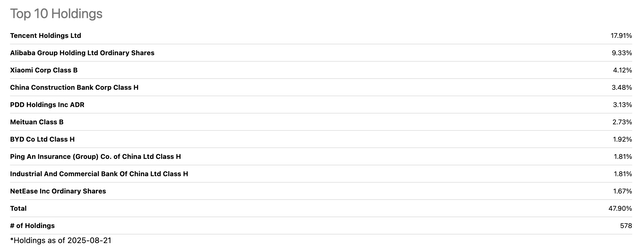

A crucial consideration for CQQQ investors is the ETF's underlying index. The index methodology can exclude certain companies, even those with substantial market capitalization and influence. This can limit CQQQ's ability to fully capture the growth potential of the entire Chinese tech sector. For example, companies facing delisting risks in the US or those with significant regulatory issues might be excluded, impacting overall performance.

Furthermore, the index's construction and rebalancing process can also introduce biases and inefficiencies. Understanding these nuances is essential for assessing whether CQQQ truly represents the broader Chinese tech landscape.

CQQQ: A Convenient Vehicle with Caveats

Despite the risks, CQQQ remains a popular choice for investors seeking exposure to Chinese technology. Its liquidity and ease of access are undeniable advantages. However, it's crucial to approach CQQQ with a clear understanding of the potential downsides.

Key Takeaways for Investors: Due Diligence is Essential

- Stay Informed: Continuously monitor regulatory developments and their potential impact on Chinese tech companies.

- Understand the Index: Familiarize yourself with the index methodology and its limitations.

- Diversify: Don't put all your eggs in one basket. Consider diversifying your portfolio across different asset classes and geographies.

- Long-Term Perspective: Investing in emerging markets like China requires a long-term perspective and a tolerance for volatility.

Ultimately, CQQQ can be a valuable tool for investors seeking exposure to China's dynamic technology sector. However, thorough research and a realistic assessment of the associated risks are essential for making informed investment decisions. Don't be swayed by hype; focus on understanding the fundamentals and navigating the complexities of this rapidly evolving market.