Portman Ridge & Logan Ridge Merger: A Risky Combination? Why Investors Should Proceed with Caution

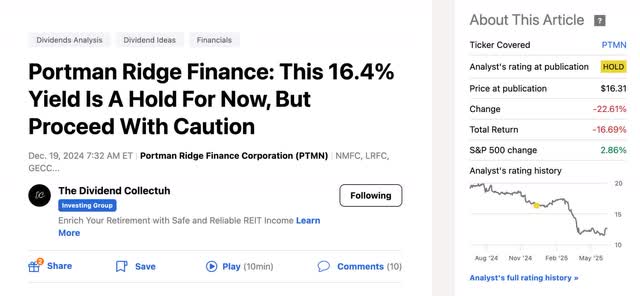

The recent announcement of a merger between Portman Ridge Finance (PTMN) and Logan Ridge Finance (LRFC) has sent ripples through the investment community. While proponents highlight potential synergies and cost savings, a closer examination reveals a complex situation fraught with potential risks. This article delves into the details of the merger, analyzing the rationale behind it and outlining why investors should exercise caution before allocating capital to PTMN stock.

The Merger: A Quick Overview

The proposed merger aims to combine the expertise and resources of Portman Ridge and Logan Ridge, creating a larger, more diversified finance company. The stated goal is to achieve operational efficiencies, expand product offerings, and ultimately enhance shareholder value. However, the devil, as they say, is in the details. Both companies have faced challenges in recent years, and the merger may simply be a response to those pressures rather than a sign of robust growth.

Why the Caution? Key Concerns for Investors

Several factors warrant a cautious approach to this merger. Firstly, both Portman Ridge and Logan Ridge operate in a highly competitive and volatile sector. The finance industry is susceptible to economic downturns, regulatory changes, and shifting investor sentiment. Combining two companies facing similar headwinds doesn't automatically eliminate those risks; it can, in fact, amplify them.

Secondly, the integration process itself presents significant challenges. Merging two distinct corporate cultures, systems, and processes is rarely seamless. Integration costs can be substantial, and delays or missteps can negatively impact profitability. The success of the merger hinges on the effective execution of this integration, which is far from guaranteed.

Thirdly, the financial performance of both companies has been inconsistent. While the merger proponents point to potential synergies, a thorough analysis of the underlying financials reveals concerns about debt levels, profitability margins, and asset quality. The combined entity may inherit these weaknesses, hindering its ability to generate sustainable returns.

Synergies vs. Realities: A Balanced Perspective

While the promise of synergies is alluring, investors should critically evaluate the assumptions underlying these projections. Are the projected cost savings realistic? Will the expanded product offerings truly resonate with customers? A healthy dose of skepticism is warranted, particularly given the track record of both companies.

Recommendation: Proceed with Prudence

In conclusion, the merger between Portman Ridge and Logan Ridge presents a complex investment proposition. While the potential for synergies exists, the inherent risks and challenges cannot be ignored. I recommend that investors exercise caution and carefully weigh the potential rewards against the potential downsides before investing in PTMN stock. A thorough due diligence process, including a detailed review of the merger agreement and financial projections, is essential. Consider alternative investment opportunities with a more favorable risk-reward profile before committing capital to this merger.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Investors should consult with a qualified financial advisor before making any investment decisions.