Navigating the Risks & Rewards of CQQQ: A Deep Dive into Invesco's China Technology ETF

Is CQQQ the Right Play for Your Portfolio? Understanding the Risks and Opportunities

The Invesco China Technology ETF (CQQQ) has become a popular choice for investors seeking exposure to China's dynamic technology sector. However, navigating this market requires a clear understanding of the unique risks involved. This article provides a comprehensive breakdown of CQQQ, examining its structure, potential rewards, and the significant challenges posed by regulatory headwinds and market limitations.

The Allure of China's Tech Giants

China's technology landscape is a powerhouse of innovation, boasting some of the world's leading companies in e-commerce, artificial intelligence, fintech, and more. CQQQ aims to capture this growth by tracking the FTSE China Technology Index. This provides investors with a single ETF to access a broad basket of Chinese tech firms, simplifying diversification compared to picking individual stocks.

Regulatory Risks: A Major Headwind

The primary concern for investors in CQQQ is the increasing regulatory scrutiny from the Chinese government. Recent years have seen stricter regulations targeting various sectors, including technology, impacting companies' operations, profitability, and valuations. These interventions can take many forms, from data privacy restrictions to antitrust investigations and limitations on specific business models. The unpredictable nature of these regulations creates a significant risk factor for CQQQ and its underlying holdings.

Index Limitations & Exclusions

Another crucial consideration is the limitations of the FTSE China Technology Index itself. The index methodology can exclude certain companies based on various criteria, potentially missing out on significant growth opportunities. Furthermore, the index's construction might not perfectly reflect the evolving dynamics of the Chinese tech sector. This means CQQQ's performance may not always align with the broader Chinese technology market.

Who Should Consider CQQQ?

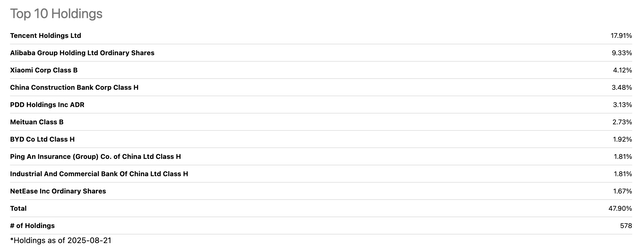

Despite the risks, CQQQ can be a valuable tool for investors with a high-risk tolerance and a thorough understanding of the Chinese market. It offers a convenient and relatively low-cost way to gain exposure to a diverse range of Chinese technology companies. However, careful due diligence is paramount. Investors should stay informed about regulatory developments, monitor the ETF's holdings, and assess their own risk tolerance before investing.

Key Takeaways

- Regulatory Risk: The Chinese government's regulatory actions pose a significant and ongoing threat.

- Index Methodology: Understand the limitations and potential exclusions of the FTSE China Technology Index.

- Diversification: CQQQ provides diversification across a broad range of Chinese tech companies.

- Due Diligence: Thorough research and monitoring are essential for successful investing in CQQQ.

Ultimately, CQQQ presents a compelling, yet complex, investment opportunity. While the potential for high returns exists, investors must be fully aware of the inherent risks and conduct thorough research before committing capital. It's not a 'set and forget' investment; continuous monitoring and adaptation are key to navigating the ever-changing landscape of Chinese technology.