Goldman Sachs Rates Marvell Technology (MRVL) as Neutral: What Investors Need to Know

Goldman Sachs has entered the Marvell Technology (MRVL) conversation, initiating coverage with a 'Neutral' rating, according to a report from Fintel released on July 10, 2025. This move by the renowned investment bank is sure to turn heads among investors following the semiconductor company.

But what does a 'Neutral' rating actually mean? And what's driving Goldman Sachs' assessment of Marvell Technology?

Marvell Technology: A Quick Overview

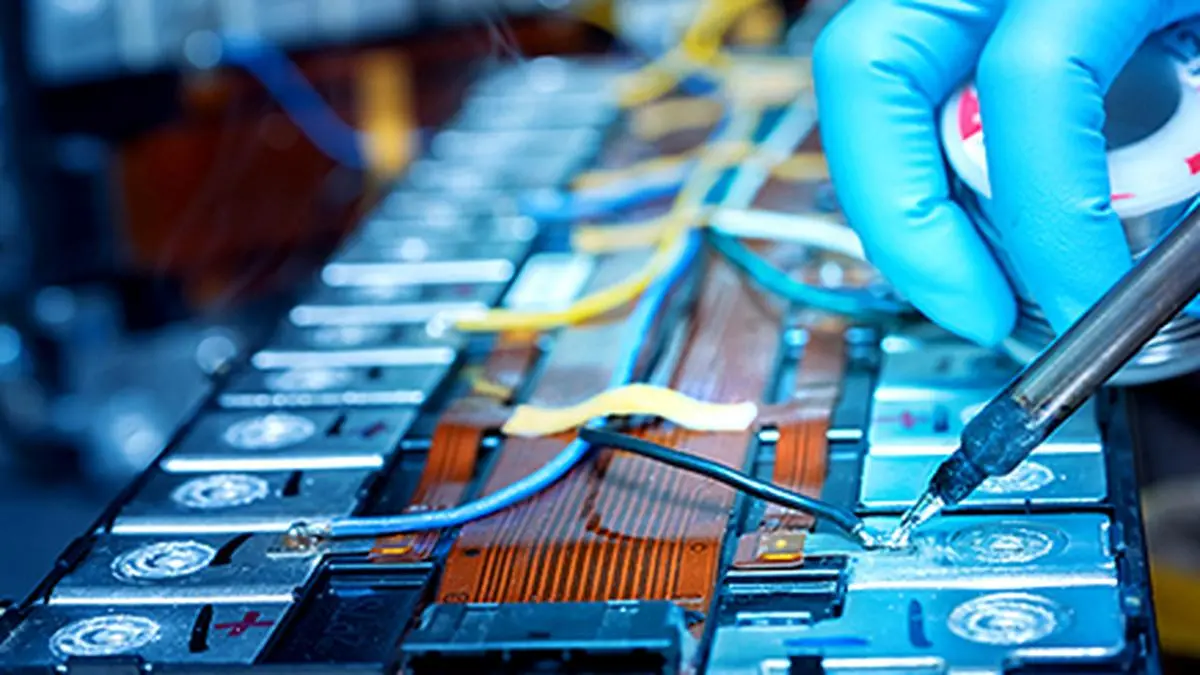

Marvell Technology Group Ltd. (MRVL) is a leading provider of semiconductor solutions, focusing on data infrastructure, 5G, and cloud computing. They design, develop, and market a broad range of products, including data processing, communications, and storage solutions. Their products are crucial components in various technologies powering the modern digital world, from data centres to mobile networks.

Goldman Sachs' Perspective: A Measured Approach

The 'Neutral' rating suggests that Goldman Sachs believes Marvell Technology is fairly valued at its current price. It's not a strong buy recommendation, indicating they don't see significant upside potential beyond the current market expectations. Conversely, it's not a sell recommendation, implying they aren't concerned about immediate downside risks.

Crucially, the analyst's price forecast as of June 20, 2025, suggests a potential 28.14% upside for Marvell Technology shares. This is a significant detail that tempers the 'Neutral' rating. While not a strong buy signal, the forecast indicates a belief that the stock could still appreciate considerably.

Factors Influencing the Rating

Several factors likely influenced Goldman Sachs’ decision. The semiconductor industry is currently navigating a complex landscape, including:

- Macroeconomic Uncertainty: Global economic conditions and potential recessions always cast a shadow on the tech sector.

- Supply Chain Challenges: While improving, supply chain disruptions remain a concern for semiconductor manufacturers.

- Geopolitical Risks: Trade tensions and political instability can significantly impact the industry.

- Competition: The semiconductor market is fiercely competitive, with established players and emerging rivals vying for market share.

Goldman Sachs likely weighed these factors against Marvell Technology's strengths, such as its strong product portfolio, diversified customer base, and focus on high-growth markets like 5G and cloud computing.

What Does This Mean for Investors?

The initiation of coverage by Goldman Sachs and the 'Neutral' rating provide investors with another data point to consider. It's essential to conduct your own thorough research and consider your individual investment goals and risk tolerance before making any decisions.

While the 28.14% upside potential is encouraging, the 'Neutral' rating suggests caution. Investors holding MRVL shares might view this as a confirmation of their existing investment, while those considering buying MRVL may want to wait for stronger positive signals.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.