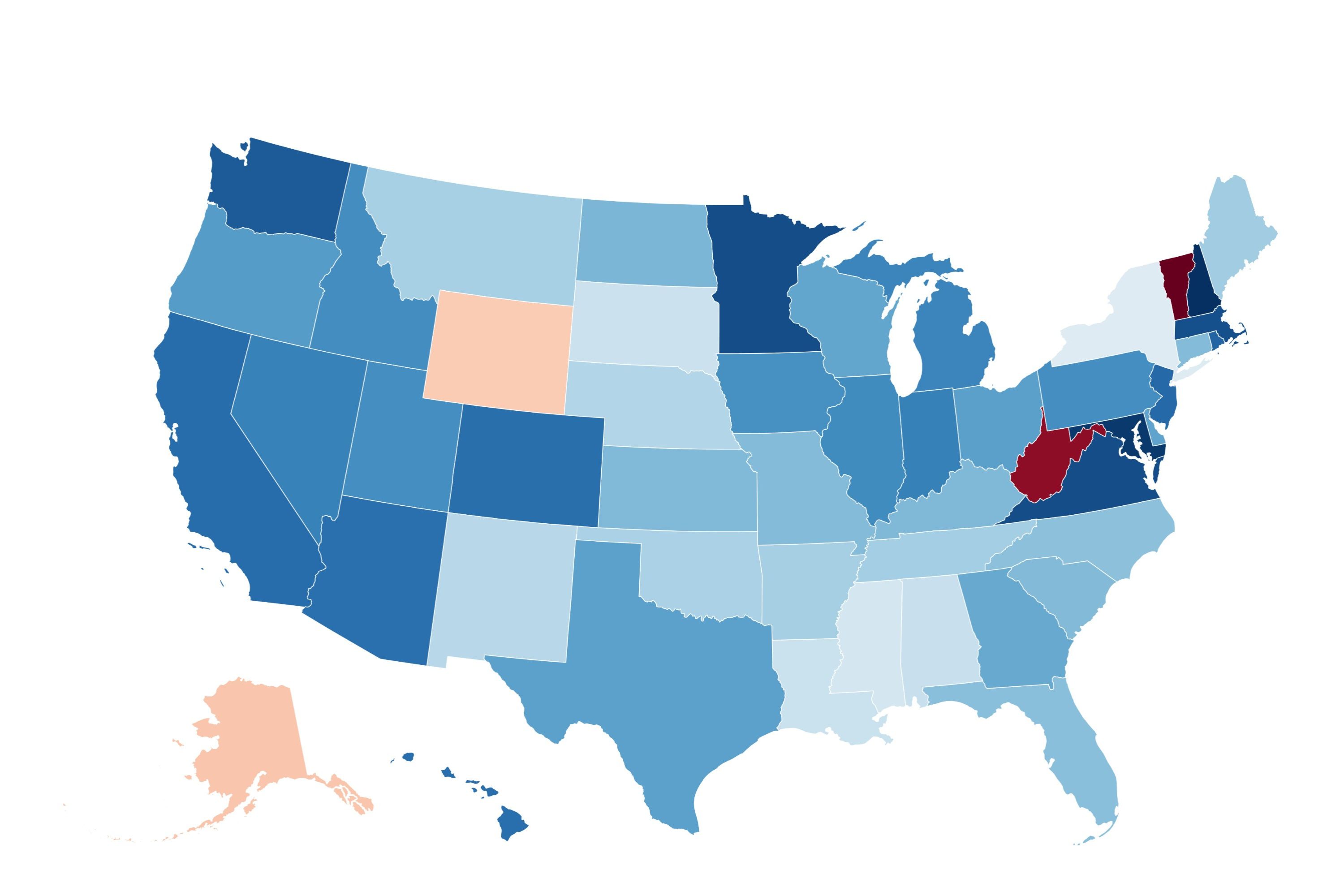

WalletHub Report: Which Aussie States Are Splurging (or Saving!) on Health Insurance?

Are you getting bang for your buck when it comes to health insurance? A new report from WalletHub has dug into the spending habits of Australians across different states, revealing some surprising insights. From the states footing the biggest bills to those finding clever ways to save, we break down the numbers and what they mean for your pocket.

The Big Spenders: WalletHub’s analysis, based on a range of factors including premiums, out-of-pocket expenses, and access to healthcare services, paints a clear picture. Some states, like Victoria and New South Wales, consistently appear near the top of the list for overall health insurance expenditure. This doesn’t necessarily mean they have *worse* healthcare, but it does suggest higher costs for consumers.

The Savvy Savers: On the other end of the spectrum, states like Queensland and Tasmania often demonstrate a more cost-effective approach to health insurance. This could be due to a combination of factors, including lower premium rates, greater competition among insurers, or simply a different approach to healthcare delivery.

What’s Driving the Costs? Several factors contribute to the variations in health insurance spending across Australia. These include:

- Age of the Population: States with a higher proportion of older residents tend to have higher healthcare costs, as older individuals generally require more medical attention.

- Lifestyle Factors: Rates of smoking, obesity, and other lifestyle-related health issues can significantly impact healthcare demand and costs.

- Geographic Location: Remote areas often face higher costs due to the challenges of providing healthcare services and attracting medical professionals.

- Insurance Coverage: The type and level of health insurance coverage people have also plays a crucial role.

- Competition Among Insurers: Greater competition generally leads to lower premiums and more consumer choice.

Beyond the Dollars: Access to Quality Care While cost is a significant concern, it's important to remember that health insurance is about more than just dollars and cents. Access to quality healthcare services is paramount. WalletHub's report considers factors like the availability of specialists, hospital bed capacity, and wait times for appointments to provide a holistic view of healthcare affordability and accessibility.

What Can You Do? If you're looking to reduce your health insurance costs, here are a few tips:

- Compare Plans: Don’t just stick with the same insurer year after year. Shop around and compare different plans to find the best value for your needs.

- Consider Excesses: A higher excess (the amount you pay out-of-pocket before your insurance kicks in) can significantly lower your premiums.

- Review Your Coverage: Make sure you're not paying for benefits you don't need.

- Take Advantage of Government Initiatives: Explore any government subsidies or programs that may be available to help with health insurance costs.

The Bottom Line: Understanding how health insurance spending varies across Australia can empower you to make informed decisions about your own healthcare coverage. WalletHub’s report provides valuable insights to help you navigate the complexities of the Australian health insurance system and find the best possible balance between cost and quality.