LendingClub: From Peer-to-Peer Pioneer to Fintech Powerhouse – Is Now the Time to Invest?

LendingClub has undergone a remarkable transformation. What started as a disruptive peer-to-peer (P2P) lending platform has evolved into a compelling fintech-bank hybrid, and it's finally showing signs of sustainable profitability. But is this the moment to jump in and add LC stock to your portfolio? Let's dive into the details of LendingClub's journey, its current performance, and whether it presents a genuine 'Buy' opportunity for Australian investors.

The Rise of P2P and LendingClub's Early Days

The early 2010s saw the rise of P2P lending, promising to connect borrowers directly with investors, cutting out the traditional banking middleman. LendingClub was at the forefront of this movement, offering attractive rates to borrowers and potentially higher returns to investors. The initial appeal was undeniable, but scaling such a business presented significant challenges, including managing credit risk and navigating regulatory hurdles.

Navigating Challenges and the Shift to a Fintech-Bank Model

LendingClub faced its share of setbacks, including regulatory scrutiny and concerns about data security. However, the company demonstrated resilience, adapting its business model and focusing on operational efficiency. A key turning point was the shift towards a more integrated fintech-bank model. This involved obtaining a bank charter, which allowed LendingClub to hold deposits and expand its range of financial products and services.

Profitability and Recent Performance

For years, profitability remained elusive for LendingClub. However, recent financial reports paint a much more positive picture. The company has consistently reported earnings beats, demonstrating its ability to manage costs and generate revenue. This improved performance is driven by several factors, including:

- Diversified Revenue Streams: LendingClub is no longer solely reliant on P2P lending. It offers a range of services, including personal loans, auto refinancing, and credit cards.

- Improved Risk Management: Enhanced underwriting models and data analytics have helped LendingClub better assess credit risk, leading to lower default rates.

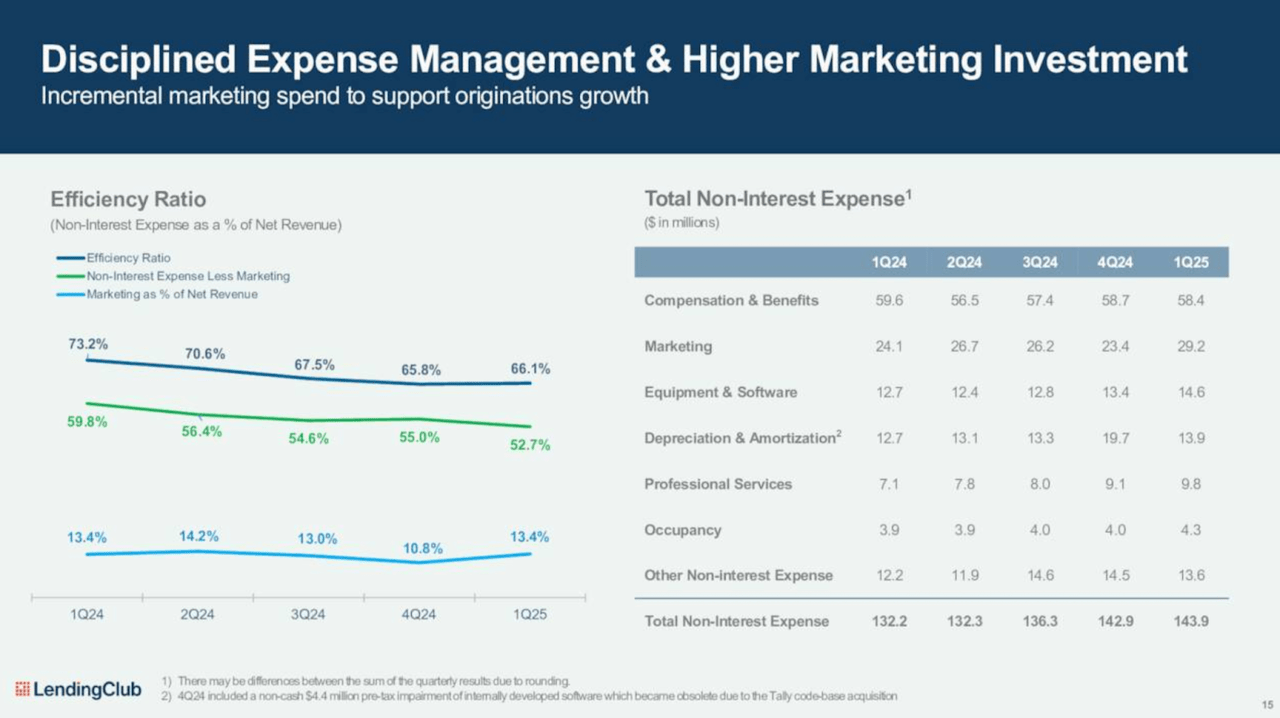

- Operational Efficiencies: Streamlined operations and technology investments have reduced costs and improved overall efficiency.

Why LendingClub Stock Might Be a 'Buy'

Several factors suggest that LendingClub stock could be an attractive investment, particularly for those seeking exposure to the rapidly growing fintech sector. Here's why:

- Strong Financial Performance: Consistent profitability and revenue growth demonstrate the company's ability to execute its strategy.

- Fintech Growth Potential: The fintech industry is poised for continued expansion, and LendingClub is well-positioned to capitalize on this trend.

- Attractive Valuation: Compared to some of its fintech peers, LendingClub's valuation appears relatively reasonable.

- Bank Charter Advantage: The bank charter provides LendingClub with a competitive advantage, allowing it to offer a wider range of financial products and services.

Considerations and Risks

While LendingClub presents a compelling investment opportunity, it's important to acknowledge the risks. The fintech sector is highly competitive, and LendingClub faces competition from both traditional banks and other fintech companies. Regulatory changes could also impact the company's business model. Furthermore, economic downturns can negatively affect loan performance.

The Verdict: A Promising Fintech Play

LendingClub has successfully navigated a challenging path and emerged as a profitable fintech-bank hybrid. While risks remain, the company's strong financial performance, growth potential, and attractive valuation make it a potentially worthwhile addition to a diversified investment portfolio. For Australian investors looking to gain exposure to the global fintech revolution, LendingClub warrants serious consideration. Disclaimer: This is not financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.