Hidden Homeowner Costs: Expert Tips to Dodge Surprise Bills and Save Thousands

Buying a home is the biggest investment most Australians will ever make. But beyond the mortgage repayments, there's a whole host of hidden costs that can quickly add up, leaving homeowners facing unexpected and hefty bills. According to recent estimates, the average Aussie homeowner forks out over $21,000 a year in these often-overlooked expenses. Ouch!

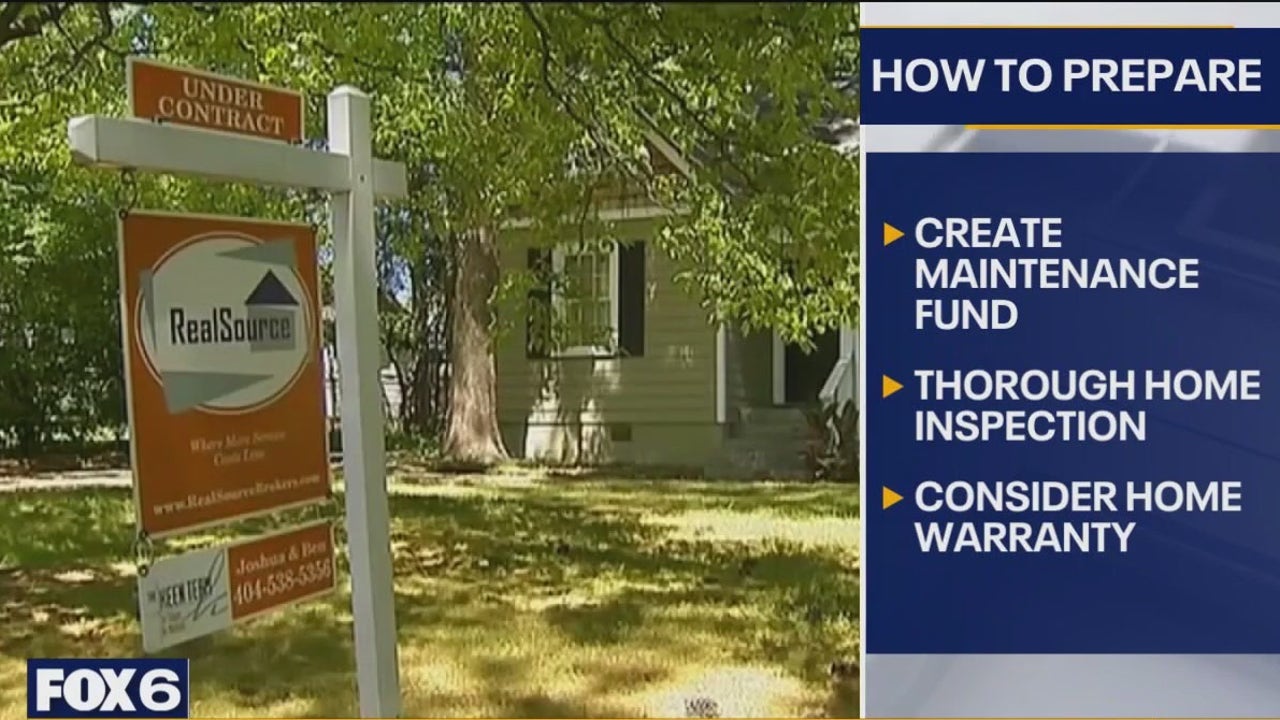

But don't despair! Dan Roccato, a leading finance professor, is here to share his expert advice on how to navigate these financial pitfalls and keep your budget on track. He recently appeared on FOX6 WakeUp to reveal practical strategies for avoiding those nasty surprise bills and protecting your hard-earned cash.

What are these Hidden Costs?

Let’s be clear – we're not talking about your standard rates and taxes. We’re talking about the less obvious expenses that can really sting. These include:

- Maintenance and Repairs: From leaky taps to broken appliances, things break. Budgeting for regular maintenance and unexpected repairs is crucial.

- Strata Fees (if applicable): For apartment dwellers, strata fees can be a significant ongoing cost, covering building upkeep, insurance, and common area management.

- Homeowners Insurance: Essential for protecting your investment against damage and liability, but premiums can fluctuate.

- Utilities: Water, gas, electricity – these costs can vary significantly depending on usage and location.

- Council Rates: Local council charges for services like waste management and infrastructure.

- Land Tax: Applicable in some states, this is a tax on the value of your land.

- Garden Maintenance: Lawns, hedges, and gardens require upkeep – either DIY or through professional services.

Dan Roccato's Expert Tips to Avoid Surprise Bills

So, how can you stay ahead of the game? Dan Roccato offers these valuable insights:

- Create a Realistic Budget: Don't just factor in your mortgage. Allocate a specific amount each month for potential maintenance and repairs. A good rule of thumb is 1-3% of your home's value annually.

- Build an Emergency Fund: Having a dedicated fund specifically for home-related emergencies provides a financial safety net.

- Regular Home Inspections: Proactive maintenance can prevent small issues from becoming major (and expensive) problems.

- Shop Around for Insurance: Compare quotes from different providers to ensure you're getting the best possible deal.

- Understand Your Strata Plan: If you're an apartment owner, carefully review your strata plan to understand what’s covered and what’s not.

- Energy Efficiency: Implement energy-saving measures to reduce utility bills – think LED lighting, efficient appliances, and good insulation.

Take Control of Your Homeownership Finances

Owning a home is a rewarding experience, but it's essential to be financially prepared. By understanding the potential hidden costs and implementing Dan Roccato's expert advice, you can avoid those unwelcome surprises and enjoy your homeownership journey with peace of mind. Don't let unexpected bills derail your financial goals – take control today!